Know How Many Types Of Bank Cheque Are There?

You can get a cheque from any bank. Remember all the banks charge different charges for this. This is no charge fix. But do you know? How many types of cheque are there? If you do not remember, you can read our complete information until the last and understand how many types of the cheque are.

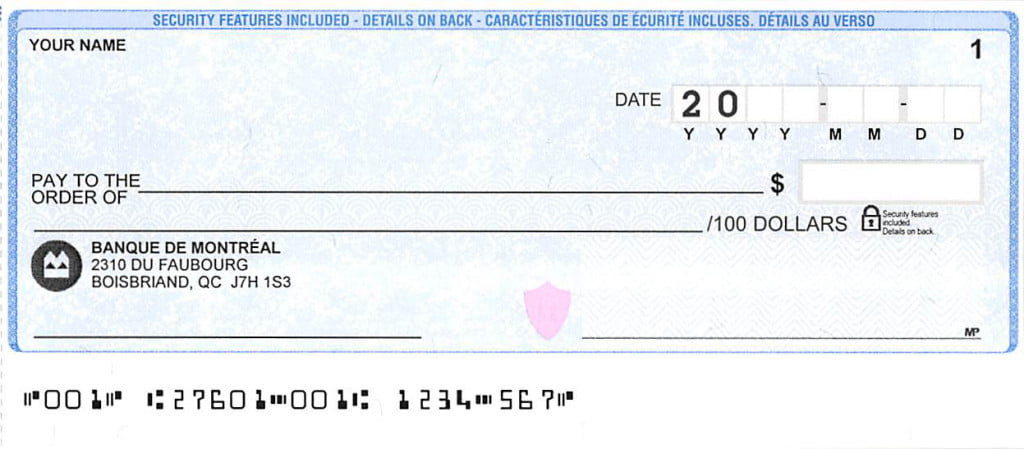

What Is Cheque?

A cheque is a type of paper piece. Which we get from a person in exchange for money. We take the piece of paper and deposit it in the bank and we give the amount of money the bank has on the cheque. This is called cheque only.

Types Of Cheque:

In short, you can say that the cheque is payable without cash, such as electronic transfers. So, let’s know here about the types of cheque…

Cheques are mainly of four types:

1. Open Cheque:

The open cheque is the cheque which can be received at the counter in the bank branch and immediately receive the cheque amount by telling this cheque on the counter. You do not have to wait for any such cheque. It can transfer the cash or directly into the bank. You can authorize someone else by signing back the cheque. This is one of the types of cheque.

2. Bearer Cheque:

Bearer cheque is a cheque that any representative of the account holder can roam in the bank. While giving the representative the sign is not required to sign the cheque and only after the cheque is given the withdrawal. These cheques may also be risky because if this cheque is forgotten then any bank can go and go and roast it.

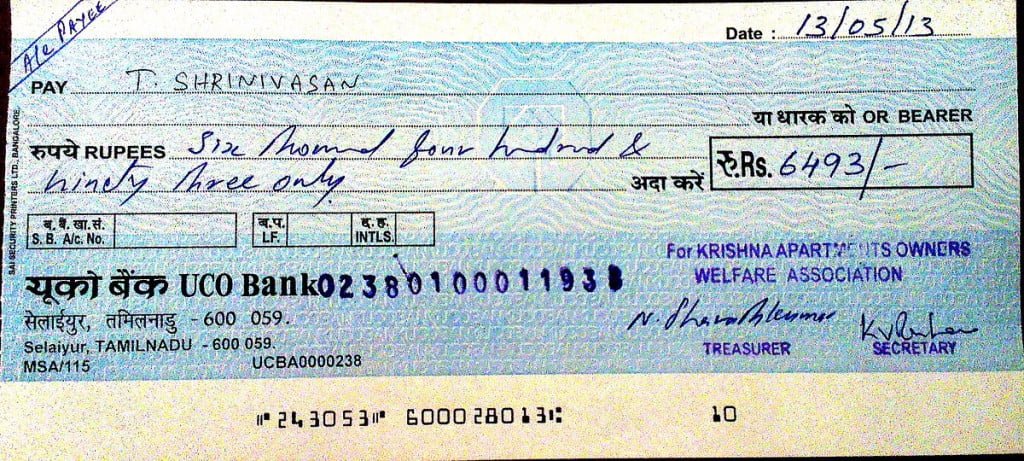

3. Crossed Cheque:

A crossed cheque is written in the name of a particular person or organization, and two parallel lines are drawn on top left, among which “or CO” or “Account Payee” or “Not Negotiable” can be written or written. This cheque does not result in cash withdrawal and the amount concerned can only be in the account of the nominee/institution.

4. Order Cheque:

In this cheque, the word “bearer” is cut and “order” is written instead. It can transfer money from the cheque to its account like an open cheque or sign it behind the cheque and authorize any other person.

A. Based on Location

1. Local Cheque:

If City A’s cheque is clear in City A, then it is called a local cheque. Just like if you got a cheque on your name, then you will have to go to the concerned branch of the city with that cheque, if you take it out of the city and clear it then you will get money separately (fixed banking charges).

2. Outstation Cheque:

If local cheques are taken out of the city and cleared by the city, then the cheque will be called outstation cheque for which the bank takes fixed charge.

3. At Par Cheque:

This is such a cheque which is acceptable in all the branches of the concerned bank all over the country. And the special thing is that there are no additional charges while clearing it out in the branches outside.

Recommended Articles :-

Business Ideas For Housewives To Run From Home

Ideas To Start Low Investment Business From Home

Small Business Ideas In India For Women’s Earning

Know Important Details About HDFC Demat Account

Planning To Start Startup? See How To Start Startup In India

Know In Details About The Trademark Registration In Delhi

B. On The Basis Of Value:

1. Normal Value Cheque:

cheques with a value of less than 1 lakh are called normal values.

2. High-Value Cheque:

cheques above 1 lakh are called high-value cheques.

3. Gift Cheque:

Gifted gifts to your loved ones are known as gift cheques. The amount of gift cheques is Rs 100 To Rs 10,000 can happen till.

C. Based on Guaranteed Payment:

1. Self Cheque:

Self-cheque is that which the account holder bank presents itself for direct payment. In it, “Self” is written in place of the payee’s name.

2. Post-Dated Cheque (PDC):

In the future, the cheque payer is a cross-cheque bearer cheque in which the data is forwarded. This means that payment of this cheque may be on or after the date of payment.

3. Ante-Dated Cheque (ADC):

This cheque is before the date of submission to the bank. This cheque can be redeemed until the completion of three months from the end date.

4. Stale Cheque:

There is a rule of redemption in every cheque within three months of the date marked on it. If this date is exhausted, the call is called interrupted cheque which is not accepted by the bank.